テクノロジー

Global business has become a catch-all phrase in tech, but founders building across borders know it is not about flags on a website or registering an office in London. To be global is to move money seamlessly between Lagos and Hamburg, to convince regulators who have never met you that your company is credible, and to design products that work in Dar es Salaam as well as in Singapore. After months of conversations with African tech professionals abroad, a pattern stands out. Many choose to start companies outside their home markets, often incorporating overseas before building back home. Access drives this choice. Certain jurisdictions open doors to payment rails, investors, and customers that remain shut in African markets.

Yet incorporation is not enough. Tech products can live on the internet and be accessible anywhere, but founders who call themselves “global” without aligning with local rules risk failure. In May, I spoke with a first-time diasporan founder whose embedded fintech product collapsed because they didn’t have the right licences. Regulators’ emails kept piling up until they were forced to shut operations. While global ambition is a well-worn territory in the venture capital space, the poser remains: what does it take to truly build a global business?

This week’s Digital Nomads looks at what it takes to build without borders. Dayo Fagade, head of business partnerships at Cedar Money, a global cross-border remittance fintech company, and Abdulwaheed Yusuf, chief operating officer at Sidebrief, a Nigerian regtech startup that helps businesses stay compliant in new markets, share insights from inside the grind of building globally, showing how much harder the work is than the word—and tech—suggests.

テクノロジー The real meaning of “global”

In fintech, the word global is often thrown around loosely. Fagade is precise about what it should mean.

“‘Global’ in money movement isn’t just about entering new countries or flag lists on a website to sound fancy,” he said. “It is about truly seamless and frictionless flows. It means a business in Lagos can pay different and multiple suppliers in Johannesburg, Hong Kong, Hamburg, and Guangzhou the same day with similar speed, transparency, and predictability as a domestic transfer.”

Achieving that requires an unglamorous amount of engineering. Behind the experience of a seamless cross-border transfer lies the hard work of stitching together fragmented payment rails, navigating volatile FX markets, and aligning compliance frameworks that rarely match. Building global payments, in his view, is less about expansion headlines and more about making disparate systems interoperate as if they were one.

“They [founders] underestimate how non-linear it is,” said Fagade. “Going global in fintech isn’t copy-paste growth. It’s closer to building several local businesses that all need to interoperate. Every market has its own compliance culture, customer behaviours, and liquidity dynamics. There’s always a need to balance building fast and building right.”

One of the biggest hurdles for location-independent founders is proving credibility in markets where they have no physical presence.

“Trust comes from proof, not proximity,” he said. “For partners and suppliers, it’s about showing you understand their specific context and will not put them at regulatory or audit risk. For banks, financial partners and regulators, that proof is strong compliance processes, clear data trails, and a willingness to engage even when the rules are complex or ambiguous.”

Trust is won through consistency, responsiveness, and transparency. Those qualities, he argues, often travel further than geography.

テクノロジー Why African professionals look abroad

Yusuf has been studying how African founders and professionals approach international expansion. He points to the recurring blind spots of those who assume the world is a single market.

“Scaling globally isn’t just copy-paste growth—it’s rethinking product, pricing, infrastructure, regulation, and culture market by market,” he said. “The mistake is building for your home market and assuming it just works everywhere. But the reality is everything from payment methods and internet speeds to pricing sensitivity and devices varies dramatically.”

The choice to incorporate abroad is often about access to the world’s dominant global payment rails, such as Stripe and PayPal, which are not universally available. Yet Yusuf also notes that integrating local systems is just as critical. A company registered in Singapore, Delaware, or Hong Kong may find itself instantly plugged into systems that remain out of reach for users in Lagos. The decision of where to incorporate often informs a founder’s global trajectory more than the product itself.

Yet incorporation abroad is not a silver bullet. Each new corridor resets the work. Customers still need reassurance that their money is safe. Regulators still demand compliance systems they can interrogate. And partners still ask if they are shouldering someone else’s risk.

“Regulations can’t be an afterthought,” said Yusuf. “Data residency, consumer protection laws, and financial licencing can block or enable entry. Running global expansion purely remotely can backfire. You need local talent or advisors to navigate culture, partnerships, and regulators effectively.”

He adds that global ambition must be balanced with intentional culture-building.

“Culture has to be actively maintained,” said Yusuf. “We [Sidebrief] had times when our culture was slipping because we just assumed it would automatically remain and had to course correct.”

テクノロジー Resilience as a currency

The founders who succeed are not those who scale fastest, but those who survive shocks. Fagade puts it plainly.

“Because things will break,” he said. “Rules shift overnight, partners will exit, markets will freeze. The companies that succeed are the ones that can move quickly without losing customer trust. Practically, that means investing early in compliance as an enabler, building strong but flexible tech infrastructure, and importantly, a team that thinks globally but operates with local empathy.”

Resilience, in other words, becomes its own form of currency. It is what allows a founder to absorb shocks, rebuild quickly, and maintain credibility across corridors.

テクノロジー The digital nomad dilemma

Digital nomads have long embodied the ideal of borderless work. Increasingly, they are also stepping into borderless entrepreneurship. The appeal is clear: they can base themselves anywhere, hire talent across time zones, and design for international markets from the start. The catch is that the dream often depends less on vision than on paperwork.

Regulatory clarity and incorporation strategy determine whether a nomad’s idea can scale into a business with global reach. Without that scaffolding, the identity of being borderless remains a lifestyle rather than infrastructure. With it, professionals who may never have launched at home are suddenly able to experiment, raise capital, and test products abroad.

The lesson echoes what Ting Shih, founder of ClickMedix, once told Inc Magazine, the entrepreneurship-focused publication, after taking her healthcare company into 16 countries: successful global businesses tend to follow a clear path.

First, identify the markets where real revenue streams exist—be ‘global’ only where you need to be. Second, find in-country partners who can bridge the cultural, regulatory, and operational gaps. Third, customise the product to fit the nuances of each market rather than forcing a one-size-fits-all model. Each cycle of testing and recalibration informs the next push forward.

テクノロジー Building without borders

The myth of the global founder is that expansion is frictionless. The reality is trench work, carried out market by market. Fagade’s insistence on resilience and Yusuf’s warnings about blind spots point to the same truth: global businesses are not created by skipping over borders, but by confronting them.

For African professionals and digital nomads alike, the opportunity is immense. Regulatory clarity offers new entry points. Digital infrastructure offers reach that was once impossible. But the grind is unavoidable.

Global-first companies are being built, not through slogans or flags, but through persistence, trust earned corridor by corridor, and resilience that keeps founders in the game when the rules change overnight.

We would love to hear what you think about this edition of Digital Nomads. Share your thoughts and ideas with us here.

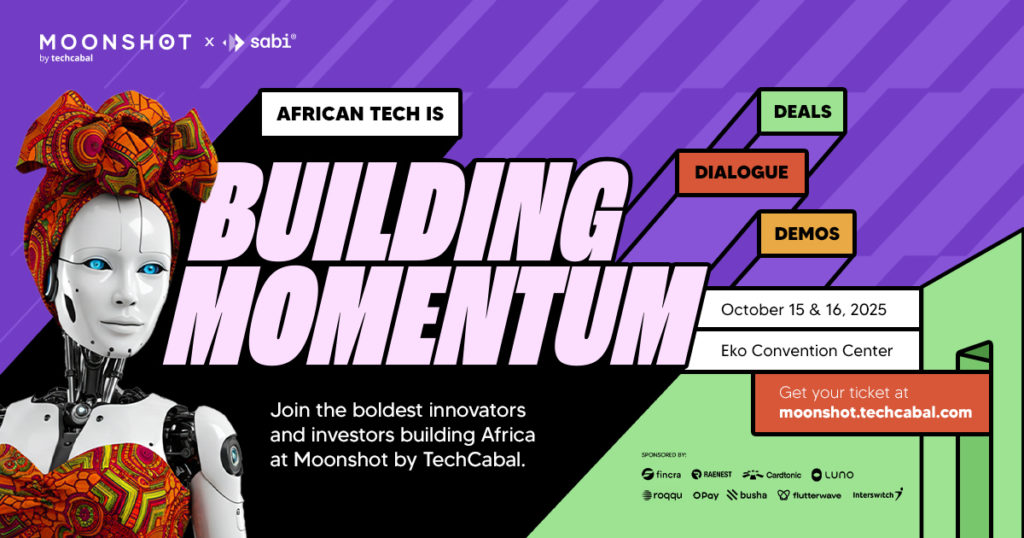

Editor’s Note: Dayo Fagade will be speaking at Moonshot 2025, our flagship event taking place on October 15–16.

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Get your tickets now: moonshot.techcabal.com